Rating

By 3 Users

Downloads

: 1

By 3 Users

Downloads

: 1

|

Price : 499

Shareware

Size :

8.69MB |

|

|

Version : 3.0 |

Major Update

|

| OS

Win98 , WinOther , Win2000 , WinXP , Win7 x32 , Win7 x64 , Windows 8 , WinServer , WinVista , WinVista x64

|

|

Excel Financial Add-in Software value options

The Derivicom This program Development analytics library is a comprehensive suite of functions with extensive cross asset derivative coverage for the financial professional. Built to support the demand of todays financial markets, This program Development gives you the ultimate in accuracy and flexibility to handle complex products and obtain critical risk information required to drive your business objectives and manage your portfolio of derivatives.

With over 60 optimized financial functions, the Derivicom This program Development analytics library helps you deliver advanced, easy-to-create business solutions fast. Value options contracts on various assets including stocks, futures, indices, commodities, foreign exchange, fixed income securities, and Employee Stock Options (ESOs). Additionally, various exotic type contracts may be valued such as Average Price and Rate (Asian options), Barrier, Binary, Chooser, Compound, Currency-Translated, Lookback, Portfolio, Rainbow and Spread options. Complex interest rate and bond option analytics along with historical volatility evaluation is included in this comprehensive suite.

The This program Development analytics library is a straightforward and easy-to-use Excel Add-in financial software package with a custom toolbar for quick access to the function library and an intuitive interface to ensure rapid productivity.

This program Development includes 10 professionally designed templates, covering all of the financial functions included within the library. Each template illustrates how to use the available functions and their various inputs empowering you to begin your option analysis today.

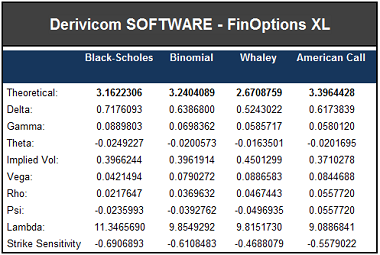

Using market data from your quote vendor, This program Development allows you to value portfolio positions in real-time, including sensitivities such as delta, gamma, theta, vega, rho, psi and lambda or calculate implied volatility values based on the prices of exchange traded options.

|

Requirements :

Microsoft Excel 2003, 2007, 2010, or 2013

|

|

By 3 Users

Downloads

: 1

By 3 Users

Downloads

: 1