Family budget application for users on the go

Personal Finances is an elegant, easy, yet technically advanced home financial manager for Windows users. Putting budget tracking on auto-pilot, the program will help users to track income and expenses, plan budget and cut back on unnecessary expenses. This program will also help you to track expected income, spending and see how much money the user will have at any date in the future. Personal Finances is portable and can run from the USB drive.

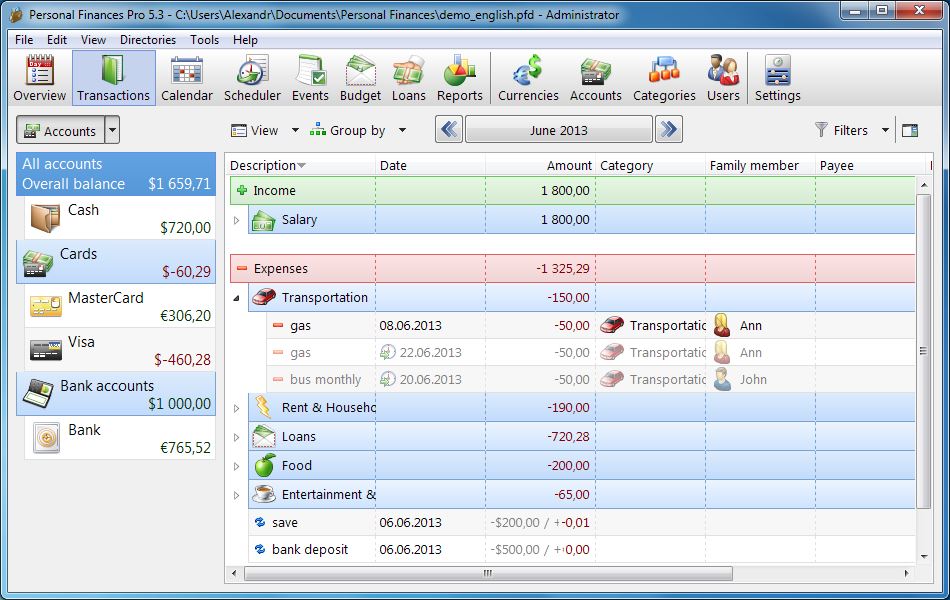

Designed with the beginner in mind, Personal Finances lets anyone take the first steps into budget planning without a shock from software complexity and learning curve. For the most part this is due to a simple, well-designed interface. The main window puts all financial transactions, accounts, tools and options in front of the user, letting you review any budget item and modify it with a remarkable ease.

To get started, the user is required to create accounts, which can be an etc, credit card, cash, pocket money, real bank account. The next step is to enter transactions, both earnings and purchases. To make it simpler with regard to the user to monitor budget in details, dealings can be defined along with family members, tags, groups. Tags help to differentiate between similar transactions that will fall into the exact same category.

Personal Finances offers a powerful reporting device that can generate cake, bar chart reports plus trands with totals plus percentages that reflect the particular flow of money for just about any period of time. The particular user can generate reviews by tags, members of the family, groups. By clicking on anything in the report, consumer can drill down much deeper to transactions associated along with the item. Reports may be saved to document in HTML, CHM, or even TXT, or printed in order to paper.

The program assists the user review the particular financial health of the house spending budget, see the spending groups that need to become trimmed to make a well balanced budget one can survive without lapsing into financial debt.

|

Downloads

: 221

Downloads

: 221